These days, getting affirmed for a home loan can be a genuine test, particularly with lodging costs continually on the ascent. In Toronto, for example, you'll be paying more than $820,000 for a home, which is almost $100K more than the average value the prior year.

Except if you're abounding in actual money, that is a ton of cash to need to think of to buy a home. Also, a ton goes into getting a home loan. Loan specialists take a gander at various elements when they're evaluating a borrower for a home loan, like a sizable upfront instalment, decent pay, and, obviously, a positive FICO rating.

Specifically, a high financial assessment won't just get you endorsed for the home loan yet an ideal financing cost also. Since economic assessments are a particularly critical piece of the loaning interaction, it's no big surprise that we get countless such requests about what qualifies as an adequate score regarding getting endorsed for a home loan.

Credit requirement for a mortgage loan

The base FICO rating expected to get endorsed for a home loan is 640. However, it would be more exact to say that anyplace somewhere in the range of 620 and 680 would be viewed as a base, contingent upon the bank. Yet, it ought to likewise be noticed that the financial assessment needed to get endorsed for a home loan relies upon a few different components related to the borrower. For instance, a borrower with a big-time salary and low obligation sum could pull off a marginally lower FICO rating than a borrower with lower pay and heaps of obligation.

Additionally, the advance sum required and the amortization mentioned will likewise assume a part in the FICO assessment needed for contract endorsement. For example, a higher advance sum would be viewed as a more hazardous undertaking for moneylenders, who may like this, require a higher financial assessment. Borrowers will likewise need to go through a pressure test during the home loan endorsement measure. With the goal for candidates to meet all requirements for home credit in Canada, they should demonstrate to their bank that they're equipped for managing the cost of their home loan instalments into the future if loan fees rise, which they probably will.

Minimum credit score requirement

THE Least FICO rating requirements for FHA home credits depend on that FHA advance thing the up-and-comer needs. All things considered talking, to get the most special financing on standard new home purchases, up-and-comers should have a FICO appraisal of 580 or better. Those with FICO evaluations someplace in the scope of 500 and 579 are, concurring the FHA rules, "confined to 90 percent LTV".

Applicants who have a base decision monetary appraisal of under 500 are not qualified for FHA contracts. Those with FICO appraisals of 500 or better are equipped for 100% FHA advance financing with no direct portion required while using the FHA 203(h), Mortgage Insurance for Disaster Victims.

The FHA considers advanced competitors with a "non-standard record or inadequate credit" may have the choice to be insisted for an FHA advance if they meet FHA necessities for such conditions.

The base FICO evaluations recorded here are subsequently for most FHA home credits for single-family homes, two or three exceptions that consolidate (anyway are not limited to) Title 1 HECM advance and HOPE for Homeowners progress. Constantly ask an FHA advance expert or your close by FHA advance expert about your monetary appraisal and what you meet all necessities for.

The lender who is more aggressive to help with credit issue

As we referenced, your financial assessment isn't the lone factor moneylenders analyze before they affirm or decrease your application. They additionally need to see a good history of obligation to the executives on your part. This implies that on top of your FICO assessment, loan specialists are likewise going to pull a duplicate of your credit report to look at your instalment record. In this way, regardless of whether your FICO assessment is over the 600 imprints, if your loan specialist sees that you have a past filled with obligation and instalment issues, it might raise a few alerts and cause them to reevaluate your degree of financial soundness.

Different angles that your loan specialist may take a gander at incorporate yet aren't restricted to:

-

Your pay

-

Your business record

-

Your general costs

-

The sum you want to get

-

Your current obligations

-

The amortization period

This is where the new pressure test will become possibly the most critical factor for every expected borrower. To qualify, you'll need to demonstrate to your loan specialist that you'll have the option to manage the cost of your home loan instalments in the years to come.

They'll likewise compute your month-to-month lodging costs, otherwise called your gross obligation administration proportion, which incorporates your:

-

Potential contract instalments

-

Potential local charges

-

The possible cost of warming and different utilities

-

50% of condo expenses (in case you're purchasing a condominium rather than a house)

This will be trailed by an assessment of your general obligation load, otherwise called your all-out obligation administration proportion, which incorporates your:

-

Credit card instalments

-

Car instalments

-

Lines of credit

-

Spousal or child support instalments

-

Student advances

-

Other obligation

Repair credit if necessary

You can use extraordinary scores into incredible arrangements — on advances, Visas, protection expenses, lofts, and PDA plans. Terrible scores can pound you into passing up a significant opportunity or paying more.

The lifetime cost of higher loan fees from terrible or fair credit can surpass six figures. For instance, as indicated by financing costs accumulated by Informa Research Services:

-

Someone with FICO scores in the 620 territories would pay $65,000 more on a $200,000 contract than somebody with FICOs of more than 760. (FICOs and Vantage Scores are on a 300-to-850 scale.)

-

On a five-year, $30,000 automobile credit, the borrower with lower scores would pay $5,100 more.

-

A 15-year home value advance of $50,000 would cost a low scorer $22,500 more than somebody with high scores.

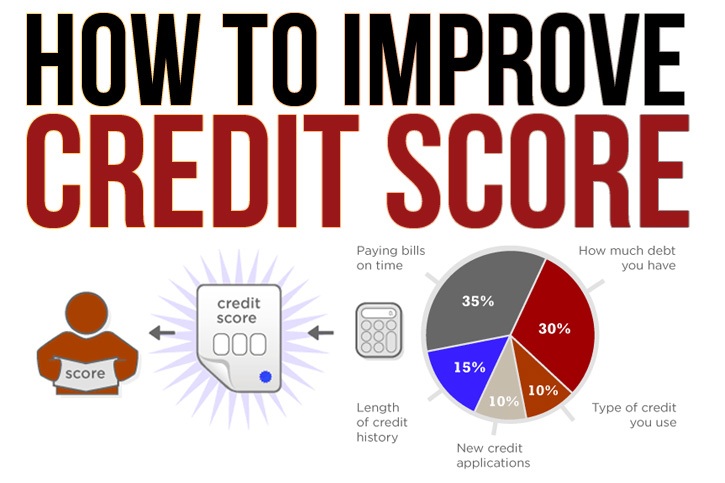

Since FICO assessments have become an essential piece of our monetary lives, it pays to monitor yours and see what your activities mean for the numbers. You can fabricate, protect and exploit extraordinary credit, paying little mind to your age or pay.

0 Comments

Leave A Comment