Chapter 7

Borrowers ought to know that there are a few options in contrast to part 7 help. For instance, indebted individuals who are occupied with business, including organizations, associations, and sole ownerships, may like to stay in business and keep away from liquidation. Such indebted individuals ought to consider documenting an appeal under part 11 of the Bankruptcy Code. Under part 11, the borrower may look for a change of obligations, either by paying off the debt or expanding the ideal opportunity for reimbursement, or looking for a more far-reaching rearrangement. Sole ownerships may likewise be qualified for alleviation under part 13 of the Bankruptcy Code.

Also, singular debt holders who have customary pay may look for a change of obligations under part 13 of the Bankruptcy Code. A specific benefit of section 13 is that it furnishes singular debt holders with a chance to save their homes from abandonment by permitting them to "get up to speed" past due instalments through an instalment plan. Also, the court may excuse a part 7 case documented by a person whose obligations are fundamentally shopper instead of business obligations if the court tracks down that the allowing of help would be maltreatment of section 7. 11 U.S.C. § 707(b).

How chapter 11 works

A segment 11 case begins with the chronicle of a solicitation with the liquidation court serving the locale where the obligation holder has a house or home. An allure may be a stubborn allure, which is recorded by the borrower, or it may be a mandatory solicitation, which is archived by banks that meet specific requirements. 11 U.S.C. §§ 301, 303. A purposeful solicitation should adhere to the association of Form 1 of the Official Forms suggested by the Judicial Conference of the United States. But if the court orders regardless, the obliged individual moreover should record with the court:

-

Plans of assets and liabilities

-

A schedule of current compensation and utilization

-

A plan of executory contracts and unexpired leases

-

A declaration of money related endeavoursThey are dealt

with. R. Bankr. P. 1007(b). If the record holder is an individual (or a couple), there are additional record archiving necessities. Such borrowers should report: a confirmation of credit informing and a copy regarding any commitment repayment plan made through credit coordinating; evidence of portion from supervisors, expecting to be any, got 60 days before recording; an attestation of the month to month net addition and any normal development in payor expenses in the wake of recording; and a record of any interest the obligation holder has in government or state qualified guidance or instructive cost accounts.11 U.S.C. § 521.

How Chapter 13 Works

A section 13 case starts by recording sales with the insolvency court serving the area where the obliged individual has a home or home. Yet, if the court orders, in any case, the commitment holder should in like way chronicle with the court: (1) timetables of resources and liabilities; (2) an arrangement of current remuneration and uses; (3) an arrangement of executory contracts and unexpired leases; and (4) an assertion of monetary undertakings. Managed. R. Bankr. P. 1007(b). The borrower should in like way report help of credit illuminating and a duplicate in regards to any responsibility reimbursement plan made through credit overseeing; proof of bit from bosses, hoping to be any, got 60 days before recording; an attestation of the month to month outright compensation and any typical advancement in payor costs coming about to documenting; and a record of any interest the commitment holder has in government or state qualified planning or educational business ledgers. 11 U.S.C. § 521.

How it impacts credit

How does liquidation influence you and your credit? First off, it can affect your FICO rating more seriously than some other single monetary occasion. While not all insolvencies cause a significant drop in your score—indeed, it is hypothetically conceivable that your FICO assessment could rise following a liquidation—any adverse consequence makes it more testing to obtain credit later on.

Declaring financial insolvency influences you in another manner by showing up on your credit report for quite a long time subsequently, giving a significant admonition sign to possible banks about an upset instalment history. A few lenders quickly deny an application when liquidation is recorded on a credit report.

Chapter 11 makes you a low credit hazard.

The Bankruptcy Code restricts how frequently somebody can record a chapter 11. When you get a Chapter 7 liquidation release, you're not ready to get another for a very long time. Banks, Mastercard guarantors, and different loan specialists know this.

They likewise realize that, with the conceivable exemption of your understudy loans, you have no uncollateralized debts and no month-to-month obligation instalment commitments. This reveals to them that you can utilize the entirety of your discretionary cash flow to make regularly scheduled instalments.

Be careful with high loan fees.

Give close consideration to the loan costs in the new credit offers you get. Visa organizations and vehicle credit loan specialists have the advantage here. They realize you need to fabricate your FICO assessment back to a fantastic FICO score. Also, they know that you'll pay a higher financing cost than somebody with excellent credit and no liquidation on their record.

Shop around

Try not to join the central Visa organization that sends you another credit offer. Shop around first. See whether there is a yearly charge for having the card. What's more, research got Mastercards. They're an excellent method to develop your FICO rating. You'll need to pay a security store. However, you will want to keep your loan fee a lot lower than with an unstable Mastercard.

In case you're financing a vehicle after declaring financial insolvency, ensure the vehicle credit is moderate. Try not to search for your fantasy vehicle. Go for a car that works for your family with regularly scheduled instalments that you can manage. You can generally redesign once your credit fix endeavours have paid off and you meet all requirements for a nearly 0.00% financing cost on another vehicle advance.

Utilize your new credit, yet don't depend on it.

After opening another Mastercard:

-

Use it consistently and mindfully.

-

Never charge more than you realize you can take care of when you get the Mastercard charge the next month.

-

Construct your credit by making the entirety of your instalments on schedule.

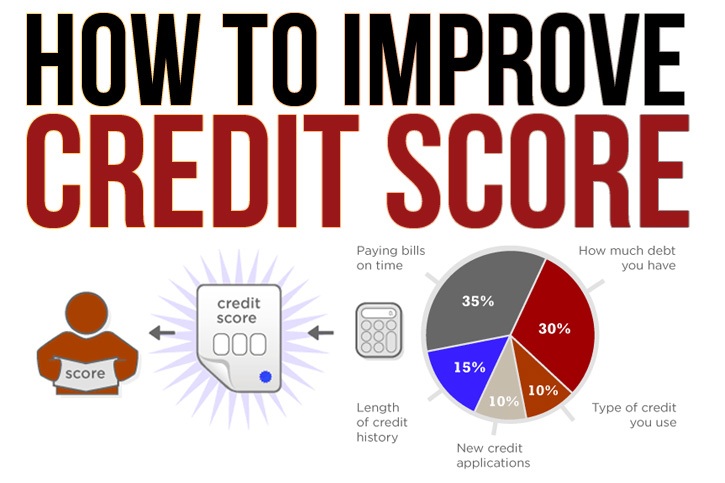

Keep in mind; your instalment history is an enormous factor with regards to your excellent score. At long last, keep the complete obligation sum on a card well beneath as far as possible. Having a ton of unused credit contrasted with your entire obligation sum improves your FICO assessment.

Loan qualification to buy a home

You're set up to buy a home – anyway, do you comprehend what kind of advance you need to move into that ideal property? There is a broad scope of home advance types advances, and each one offers a phenomenal course of action of advantages.

We'll examine six of the most notable home advance sorts and who should get them.

1. Fixed-Rate Conventional Loan

Who's it for? Homebuyers with a solid financial profile need a dependable and noticeable routinely booked portion.

Fixed-rate ordinary home advances are the most broadly perceived sort of home credit. Rather than various kinds of home advance credits, you can use a standard home advance to buy most types of private properties.

Average home loans have stricter FICO ratings and a relationship of obligation to pay after charges abilities. It would help if you had a monetary evaluation of 620 concentrations. Your D.T.I. extent should not be identical to half to possess all the necessary qualities for development with most home advance moneylenders.

2. Adjustable Rate Mortgage (A.R.M.)

Who's it for? Buyers who purchase a home plan to move out of a few years or who expect to deal with their development early.

An A.R.M. is a sort of standard home loan with a moderately more jumbled interest structure. A.R.M.s start with an introductory fixed-interest period. The fixed-rate period might be just about as short as five years or as long as ten years, dependent upon your credit subject matter expert.

During this period, you'll approach a fixed rate that is lower than current market rates. After the introductory period shuts, your financing cost will rise or fall, dependent upon how current market advance expenses move.

3. USDA Loan

Who's it for? Occupants who need to buy a home in a country or rustic locale and have a done for portion.

The USDA advance is a sort of government-supported agreement. Like this, such passages are more secure for banks to offer to buyers with lower financial and credit necessities. Nevertheless, to possess all the necessary qualities for an organization upheld in advance, both you and your home ought to fulfil the credit's intriguing rules.

A USDA advance can allow you to buy a home with $0 down. Whether or not you have no forthcoming portion, you won't have to pay for PMI like you would with a standard home loan. Taking everything into account, you'll pay a more reasonable affirmation charge. You may even have the decision to roll your affirmation charge and closing expenses into the central harmony of your credit.

Repair credit is still needed to fix any issue

1. On the off chance that you discover mistakes, debate them

The subsequent stage in credit fix is to question incorrect data on your credit report.

Mistakes aren't typical; however, they occur. Some of the time, terrible credit is only your shortcoming. You shouldn't attempt to contend with exact data, yet if you do see blunders, even little ones—it merits tidying them up. Here's the ticket:

When you have the duplicate of your complete credit report close by, check your character data (Social Security number, spelling of your name and address) and record loan repayment.

Survey the rundown of Mastercards, outstanding obligations, and significant buys. If you see any mix-ups or sketchy things, duplicate the report and feature the blunder.

2. Stop the dying

When you manage any blunders on your credit report, it's an ideal opportunity to guarantee you're not as yet spending beyond what you can bear the cost of every month.

For what reason is this so significant? This is because there are just three primary intentions for fix terrible credit:

-

Pay the entirety of your bills on schedule

-

Pay down obligation (particularly Mastercard obligation)

-

Avoid applying for credit

3. Cover all bills on time, going ahead

On the off chance that you need to fix awful credit, you need to begin paying the entirety of your month-to-month charges on schedule, period!

In case you're behind on any bill, get up to speed in a hurry. On-time instalments are the absolute most significant factor surprisingly scored. Your credit will not improve until you can reliably take care of each bill on schedule.

One drawback of this is that you don't acknowledge essential bills like your month-to-month telephone and utilities. Experian Boost can assist with that. The free assistance connects your ledger to Experian to screen your regularly scheduled instalments.

4. Pay down Mastercard adjusts

Assume responsibility for your Visas by squaring away their equilibriums.

If you have any extraordinary equilibriums, make room in your financial plan to square away these obligations step by step, each month until they are no more.

Realize your credit cutoff points and bend over backwards to remain well under the greatest while charging things.

5. Try not to apply for new credit

At long last, oppose the compulsion to open another Visa, in any event, when a store offers a rebate on your buy for doing as such.

Each time you apply for credit is recorded on your acknowledgement report as a "hard request", and on the off chance that you have an excessive number of inside two years, your financial assessment will endure. All in all, a purchaser with excellent credit can apply for credit a couple of times every prior year it starts to influence their financial assessment. In case you're as of now beginning with sub-optimal credit, notwithstanding, these requests may affect your score and defer your definitive objective of watching your FICO rating climb.

0 Comments

Leave A Comment