Credit scores are not static; they change when the information on your credit report

changes. This means you can now control your financial status and take actions that will

positively impact your credit scores. Here's how.

1. Check your free credit score

First, check your credit score for free to see the factors that affect it the most.

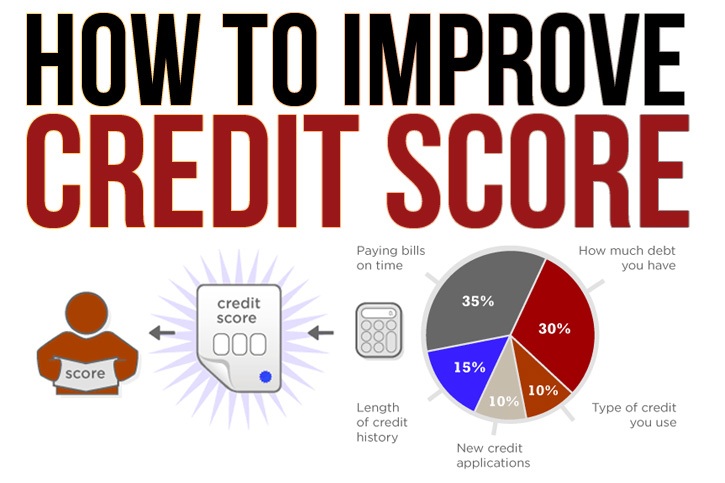

The following elements have the most significant impact on your credit score:

Your payment history (35%), including whether you consistently pay your bills on time

or have been late or missed payments in the past.

How many credits you have and how many you actively use is called the credit

utilization rate (30%).

How long do you use the credit (15%)?

A combination of your existing and currently used credit types (10%).

Several last credit accounts you opened and applications submitted, called complex

requests (10%).

It is also essential to check your credit report for errors, including inaccurate personal

information or fraudulently opened accounts on your behalf. Significantly if it negatively

affects your score, dispute this information with credit bureaus. Submitting a dispute

does not affect your credit. But if the content of your report changes, your score may

also change.

2. Pay bills on time

Payment history is your most important credit score, accounting for 35% of your FICO®

score. One of the best ways to ensure you're never late is to set up an automatic payment

for recurring bills, such as student loans and car payments. On the day of payment, the

account will be received directly from your bank account, so you do not have to

remember to log in to the payment portal or send a check. Make sure you have enough

money in your checking account to cover your payments; otherwise, you may be

charged.

If any of your bills have to be paid on the same day of the month, making it harder to

pay them on time, you may be able to change payment terms with your creditors. Keep

in mind that it may take several billing cycles for the change to take effect. So continue

to pay as required until they approve the upgrade.

It is also essential to know in advance creditors' ability to pay. For example, federal

student loans come with alternative payment plans that can reduce the amount you owe

each month. But you may not know about them if you don't want to contact your student

loan administrator about your options. Credit card issuers may also reduce your

payment or interest rate for some time if you are experiencing financial difficulties. If

you're worried about missing a payment, contact your creditor after researching what's

possible.

3. Pay off the debt

Amounts due amount to 30% of your FICO® score, the next most significant portion

after your payment history. The amount of the credit limit currently used is expressed as

the credit utilization rate, and experts recommend that no more than 30% of the credit

limit be used at any one time.

Ideally, you should pay your entire credit card bill at the end of each month. But if you

can't and currently have a balance, make a plan to stop using your cards and pay off

your credit card debt. First, you may want to spend the extra money on a maximum

interest card called the debt avalanche method, which will save you the most money on

interest. Or you can pay off small balances using the debt snag method, which can

motivate you more.

A credit card balance transfer may be a better option if you need more time to reduce

your balance. If your credit score is correct for you, a balance transfer card gives you an

interest-free period that allows you to pay your balance without collecting as much tax

over time.

However, to make the most of your card, come up with a plan that will get you debt-free

for an interest-free period. Otherwise, you will be charged interest at the end of that

period, which may negate some of your savings.

4. Avoid new complicated queries

If you've focused on increasing your score, in the meantime, you may want to postpone

applying for new credit. A complex investigation occurs when a lender checks your

credit to evaluate your financial product. This will appear on your credit report and may

affect your credit score. This is because lenders may consider a higher credit risk if you

borrow money from many different sources. Applications for a new credit account will

receive 10% of your FICO® score.

Easy queries do not affect your credit; they occur when you check your credit score or

when a lender or credit card issuer checks your credit to confirm in advance that you are

a product. It is also likely that you will not see a more significant impact on your score if

you buy one auto loan or mortgage. And you contact several lenders in a short time.

Scoring models distinguish this process from, say, opening multiple credit cards at once

and will not usually result in the criminal's same result.

5. Increase your credit

One way to strengthen credit using your existing financial history is to use Experian

Boost TM. When you sign up for free, Experian will look for your bank account details to

make payments for utilities, phone, and cable, and you can choose which bills to add to

your credit file. When you add invoices, a new credit score is generated immediately.

The FICO® score may increase due to new positive payment history for those with little

or no credit.

6. Get help creating credit

If you're having trouble verifying your credit card or loan on your own, you can create a

credit history with others or with a secure account. Try these strategies:

Become an authorized user on another person's account.

Work with a good creditor. When you have a guarantor for a loan or credit card, the

lender also holds them jointly liable for the debt.

Open a secure account. With a secured credit card account, you deposit cash into the

account, and the card issuer allows you to borrow up to a certain percentage of the

money.

How to maintain a good credit score

When you do the hard work to eliminate a bad credit score, the next step is to maintain

momentum. This means you pay all your bills carefully on time, keep your credit card

balance low, and only look for new credit when you need it.

Your credit history duration is 15% of your FICO® score, so you may want to keep your

old accounts open to maintain a long average credit history. This may mean that you

occasionally deposit the oldest card and pay for it immediately. If your card has a high

annual fee and you no longer use it, weigh the potential trade-offs of shorter credit

history with the money you could save.

Need More Guidance on how to build a good credit fast?

KINDLY Visit our website www.mycreditmaster.net

0 Comments

Leave A Comment