Many people look for lending before buying a residence. Before it is provided, loan providers would usually check several aspects to ensure the customer is qualified. Among all variables that could influence financing approval, the credit report is one of the most vital ones.

Understanding what is Credit score

People depend on credit scores because they do not have to use their cash to buy something. If you have this, you can get anything that you want quickly, and also, it would certainly not matter how much actual cash you have in your savings or inspecting account. Equally, as long as you make on-time payments, your credit will keep going as well as going.

Although having debt makes life easy, it features excellent responsibilities. It requires to be preserved since many lenders or even landowners use this as a reference. Your debt can talk much regarding you, especially on how responsible you are as a borrower or a renter. The much better your credit history report appears, the more people can trust you economically.

Credit score and Home acquiring

As discussed above, the credit report is essential in the loan application, such as a home loan. Fair Isaac Company has created a racking up system used by most lending institutions. This is precisely how they establish if you are gotten a home mortgage and also whether you are obtaining more affordable rates of interest or not.

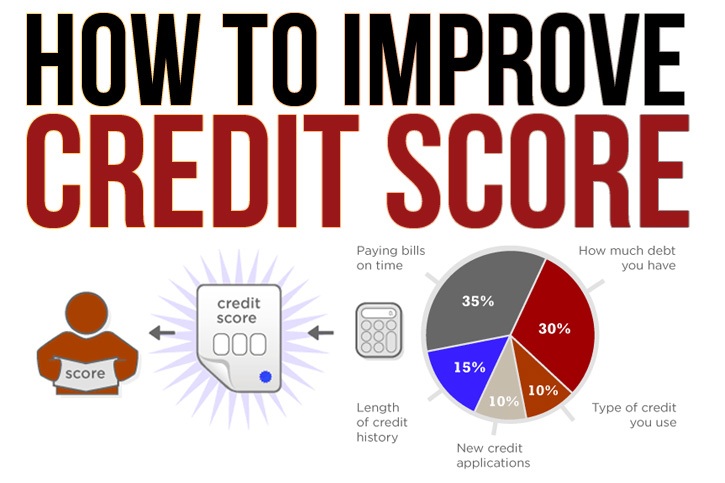

The scores can be affected by your background payments, arrearages, the size of time you had a credit report, the establishment of new credit scores, and the sort of credit scores you have. Each of these aspects has its particular percentage. The more excellent score you obtain, the better offers you get with loans.

It is good if an individual can pay money for his house. However, reality claims that not all can afford house purchasing in this fashion. Many people depend on a home mortgage to get their dream house. If credit ratings are terrible, you can flush down your desire to end up being a property owner.

The Refine of Debt Repair Work

Debt can be influenced in several ways. It can go bad every single time you miss payments and if you applied for personal bankruptcy. Even if one more individual utilized your bank card fraudulently, it can drag down your credit report without your understanding.

So precisely how do you fix this mess? The adhering to are few basic methods to do it:

1. Get a copy of your debt report and determine any errors in reporting. Compose a letter to inform the mistakes and request for improvement; after that, send them to the CRA. You need to additionally send any documentation that might corroborate your stand together with your letter.

2. Take into consideration keeping your old accounts.

3. Make on-time repayments, and also, as long as feasible, keep your charge card balance at a minimum.

4. Limitation the people who can inquire concerning your credit history.

5. As much as feasible, do not get brand-new credit cards before applying for the loan. Although this may boost your exceptional balance, lenders may come to be uncertain if you genuinely are financially stable. If you need to, obtain them after a home loan is accepted.

People that have undertaken bankruptcies and foreclosures may need to wait years before obtaining their subsequent financing. Although repairing their credit scores can not be done overnight, it is still possible to cut the duration short. Individuals who have reduced credit ratings can try to obtain safe and secure financial obligations and make timely repayments. As time passes, the good reports will quickly exceed the poor. Therefore, a home loan can be authorized (but normally with more excellent prices).

Currently, do you see the reason that credit history must be repaired before buying a residence? If you do, begin repairing it as much as increase your credit report. Do this prior to obtaining finances. As soon as you do, you will certainly be guaranteed of the very best bargains and rates of interest.

0 Comments

Leave A Comment