What is a credit check?

The term FICO assessment implies reliability. With the goal that the bank can loan you cash for a portion of the credit, it is significant for them to know whether you can and will reimburse the sum. That is the reason she does a credit look before taking the portion in advance. Your past instalment conduct and monetary conditions will be assessed - from one viewpoint dependent on bank-inside models and then again dependent on your assessment at Schufa.

This credit check has a colossal effect on the loan cost you get: the higher the bank evaluates your financial soundness, the less expensive the financing cost it offers you. Coincidentally: According to Schufa Kredit-Kompass 2018, the credit office has negative highlights put away for 9.4 per cent of customers that would make it hard to get. This implies that more than 90% are evaluated decidedly and can expect a low loan cost because of their excellent reliability.

What is checked as a component of the credit check?

On the off chance that the bank needs to check your reliability, individual information like marital status, occupation, and a home spot are mentioned first. These give data about instalment conduct in your space of residence or for individuals with a comparative expert and marital status. Also, financial data, for instance, about organization property and data about past instalment conduct, affect reliability. Most importantly, it is checked how solid the client has been in the past with reimbursements or whether there have been install anomalies. The bank requests this information from an acknowledged office like Schufa.

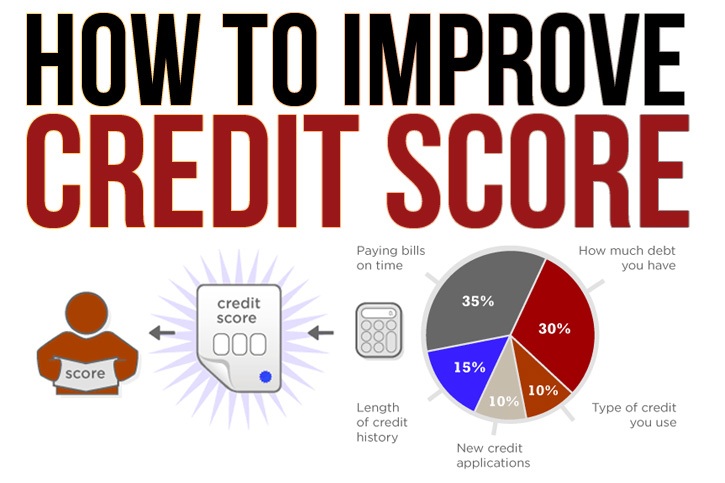

Here you can see every one of the variables engaged with a credit check:

Individual information:

-

Last name

-

Date of birth

-

Sex

-

Address

-

Moving recurrence

-

Work

-

Conjugal status

Past instalment history

-

Conceivable bankruptcy procedures, assortment information, or sections in the account holder registry

-

Have all cases been settled so far as per the agreement?

-

Have instalment abnormalities previously happened?

Financial conditions

-

Data about existing or finished advances

-

Information on current agreements (phone, renting, online seller)

-

Number of financial records and Visas

-

House buying

Corporate ventures

The more information there is on a client, the more unequivocally an assertion can be made about his reliability. They fill in as the reason for deciding the credit score, which addresses the likelihood of the advance being reimbursed in full.

How banks figure financial soundness?

On account of an advance solicitation, the bank's inner credit check models are applied first. Precisely what these are is, for the most part, mysterious and varies from one bank to another. Since, as indicated by the Federal Court of Justice, the scoring interaction is a proprietary advantage deserving assurance (Ref.: VI ZR 156/13). The specific computation equations along these lines don't need to be uncovered.

It is known, notwithstanding, that the pay and existing liabilities make up a piece of the credit check. Confirmation of pay and bank explanations should be introduced to the bank for this reason. What's more, a credit office - generally Schufa - has gotten some information about the financial circumstance and instalment history: This remembers developments for current records, reasonable reimbursements of advances and renting contracts, and the number of Master cards.

How to get a free credit report?

Getting a copy of your credit report is a fast and easy way to manage, control, administer, influence, and direct your assets. Regularly reviewing your credit report will aid you in detecting fraud early and ensuring your credit affiliations have the correct details. There are many ways to receive a free see report to be as trustworthy as possible.

You can visit at www.annualcreditreport.com for a free annual credit report.

Is it true that checking my credit report will damage my credit?

No, obtaining a copy of your credit report will not harm your credit score. Checking your credit score is also not detrimental to your credit. These acts are referred to as "soft pulls," and they have no bearing on your credit score. Actions that necessitate a "strong pull," such as applying for a credit card, temporarily lower your credit score.

Do I have to pay for my credit report?

It depends. There are many free credit report tools out there, but there are also a lot of paid options. With so many free resources available, there isn't any need to pay for your credit report. Just Make sure you get your credit report from a trusted source, such as one of the sites mentioned in this guide or one that begins with "HTTPS."

Requesting Your Report

The Fair Credit Reporting Act (FCRA) gives you the privilege to a free credit report in specific conditions notwithstanding your free yearly credit report. These conditions incorporate the accompanying:

You had an application denied due to data on your credit report. It incorporates credit, protection, and work applications. You have 60 days from the date you learn of the forswearing to request a free duplicate of your credit report. The organization will send you a notification that incorporates contact data for the credit agency that gave the information utilized in settling on the choice. You are jobless and plan to start searching for a task within 60 days. You are on government assistance. You are a survivor of wholesale fraud and have incorrect data on your credit report.

Bit by bit instructions to obtain your free credit reports

-

Select your state and afterwards click REQUEST REPORT.

-

Fill in your data (first name, last name, date of birth, government-backed retirement number, and current location).

If you have not inhabited your present location for at any rate two years, you will likewise have to incorporate your past address.

-

Snap Continues.

-

Select every three (3) diverse credit detailing organizations (Equifax, TransUnion, and Experian).

-

Snap NEXT.

-

Snap NEXT to proceed. You will be moved to the Equifax site.

When you are done at the Equifax site, click on Return to AnnualCreditReport.com, situated in the menu bar at the highest point of the screen.

EQUIFAX WEBSITE INSTRUCTIONS

-

Enter the last four digits of your federal retirement aide number.

-

Snap-on Click to Continue.

-

Answer the security addresses which depend on the data in your document.

-

Snap-on Click to Continue.

-

Snap-on the Get Started to connect.

-

Print and Save Report.

-

To save your acknowledge report as a PDF, click on Save as PDF. Save to your hard drive or circle. To print your account, click Print Report.

0 Comments

Leave A Comment