There are many misconceptions about credit repair. There are many companies out there marketing to folks telling them they can boost their score of 200 points in a couple of weeks. The fact is that many of those claims are not true, and the methods used are either unscrupulous, illegal, or simply not real.

The following steps anyone can take in order to boost their credit score. (your credit score can be the difference between a prudent borrower qualifying to buy a house and not in this market)

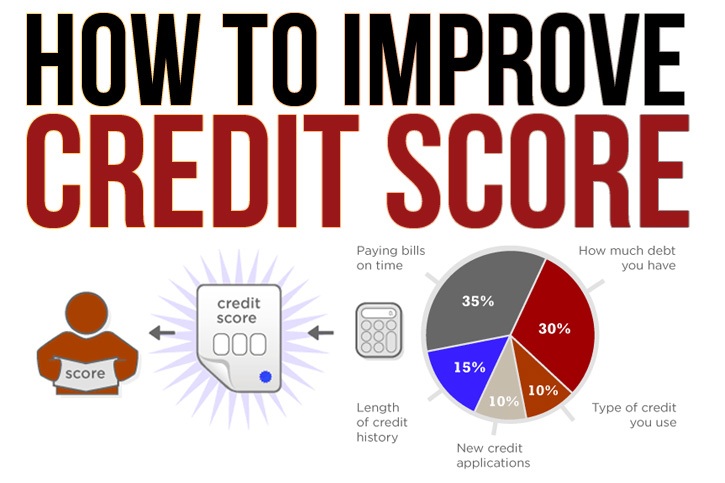

1. Keep a 25% balance or under on any unsecured credit card you have. (ex. $1,000 limit should keep your balance below 250).

2. Dispute ONLY erroneous information on your account. (If you dispute everything on your account you can sometimes do more harm than good.

3. When you pay off a credit card, DON'T close it. (Available credit cushion is a huge factor into your credit score.) Banks want to see that you could use credit if you wanted to, you just choose not to.

4. This may be common sense but... Don't be late on any of your payments that report to credit bureaus. If you have to be late, don't be more than 30 days late on ANYTHING ever. This is the single fastest way to bring your credit score down. If you are going to be late on anything, call your creditor and let them know first and make them put in writing they will report to the credit bureau.

5. If you have credit available and the money to pay it off, use it then pay it off IMMEDIATELY.

6. (THE MOST IMPORTANT) Live within your means. Don't use credit to finance your lifestyle. Create a budget and stick to it every month. (use tools like mint.com to help)

Use these tips and you can boost your score tremendously over time. Your score will not go up 150 points in a day if you follow these tips, but can go up substantially in a 3-6 month period if you follow these guidelines.

In this current lending environment banks look for reasons to turn people down, so the better your credit score the better chance you have of qualifying and buying the home of your dreams.

[https://mycreditmaster.net] is a program that gives anyone the credit-building tools and market knowledge to get a great deal in this market.

Richard

May 5, 2021

I don’t carry any balance on credit cards and have never been worried about my score. But, I never thought to check my reports for accuracy. I’m going to order a copy and check them as you suggest. Thanks.

flavored coffee beans

January 22, 2022

Plus, we love that Lifeboost is committed to healthy coffee.